Let’s face it! Saving money and monitoring your expenses are two habits that are hard to commit to. Fortunately, you can improve your money smarts by using a savings vs. shopping tracker layout for your bullet journaling.

In this article, you’ll find

- a free printable PDF download of a savings vs. shopping tracker layout for your bujo

- reasons why you should track your savings and spending

- instructions for creating a savings vs. shopping tracker from scratch

- tips on personalizing your journal spread with unique variations and inclusions

As a self-confessed shopaholic, I used to spend my paycheck on splurges to reward myself for being productive. However, I would later feel guilty about it once the credit card billing arrived and my bank account reflected the minimum balance left. Thankfully, I came across a savings vs. shopping tracker that allowed me to stay on top of my finances. If you want to be mindful of your money’s ins and outs, I’ll show you how this bujo layout helped solve my dilemma.

What Is The Savings Vs. Shopping Tracker Layout?

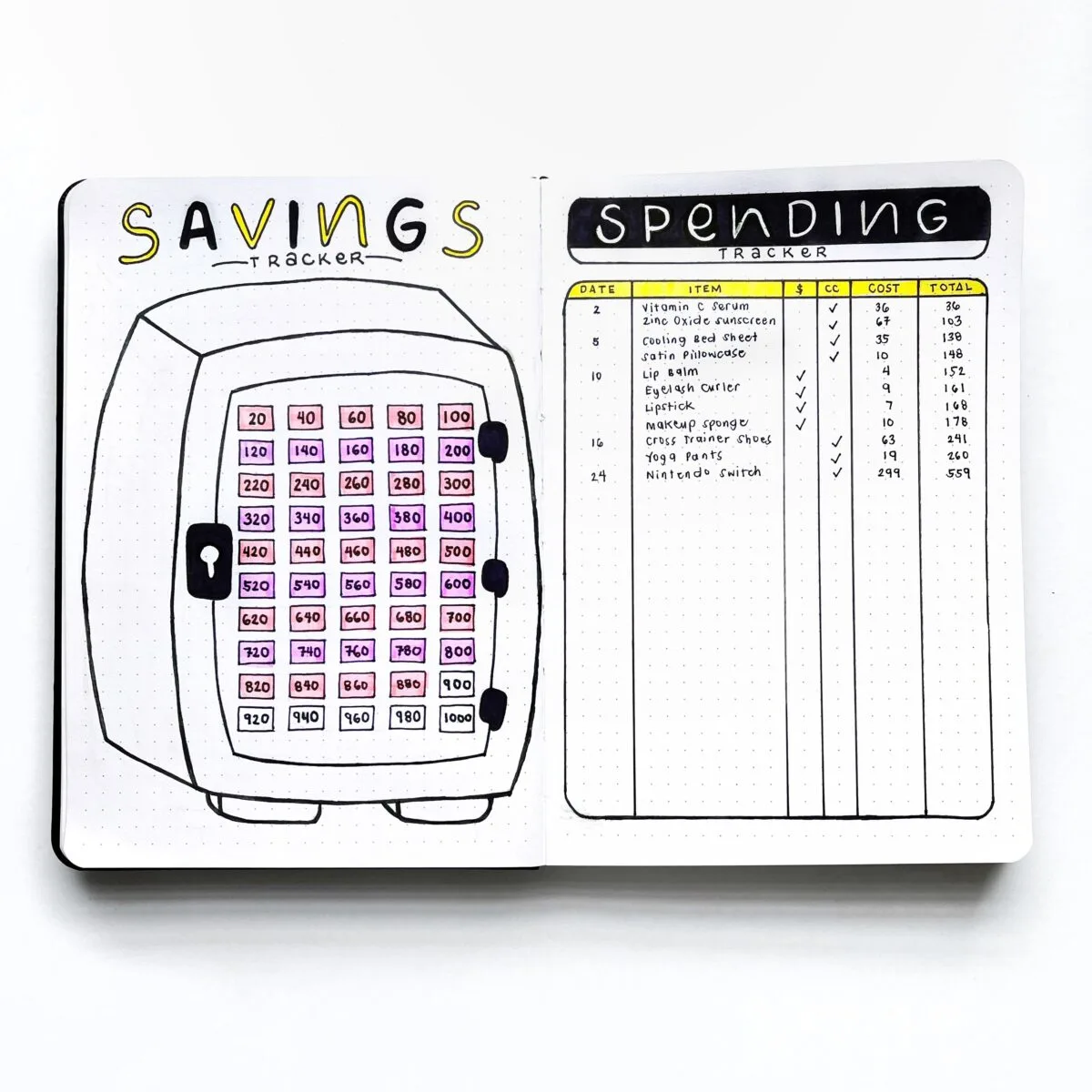

A savings vs. shopping tracker layout is a bullet journal spread that helps you monitor your finances as they come and go. Its name is based on the fact that you place the savings tracker next to your spending logs for comparing figures and reviewing your expenditures at a glance.

This layout has two parts: the savings tracker and the shopping tracker. The savings tracker shows how much you have put aside in the bank or your wallet for future funds. Meanwhile, the shopping tracker shows you the tally of cash and credit purchases you’ve made on personal splurges.

Note that the shopping tracker is named this way to exclusively monitor your spending on items that do not fall under the basic necessities.

How the Savings Vs. Shopping Tracker Helps in Your Finances

Keeping a savings vs. shopping tracker in your bullet journal allows you to stay on your budget by giving you an overview of how much you’ve saved and which items you splurged your earnings on. According to a study, knowing how you handle your money has a positive impact on your spending habits 1.

A savings vs. shopping tracker layout is a great way to visualize your progress towards fund building. Instead of trying to recall where your allowance went, you can simply consult your bullet journal to see which items you spent it on and if you actually saved it in your bank account.

More than just motivating you to stick to your budget, a savings vs. shopping tracker also helps you address your spending issues. By keeping tabs on items you regularly splurge on, you can see negative spending patterns that can be reversed by developing the habit of saving.

A spending vs saving budget can be especially helpful as you save towards a big life adventure like international travel or a season of #vanlife. For example, tracking not spending money on food deliveries and professional manicures can help you track exactly how much closer you are to getting your RV washer and dryer and setting off on your adventure.

Download This Free Printable Savings Vs. Shopping Tracker Layout

If you want to start logging your savings and splurges to avoid forgetfulness, you can use this printable PDF of the savings vs. shopping tracker layout for your bullet journal. As this is a two-page spread, printing it will save you time and effort instead of having to do everything from scratch.

How To Make A Savings Vs. Shopping Tracker Layout In Your Journal

How To Make A Savings Vs. Shopping Tracker Layout In Your Journal

Total time: 15 minutes

Draw an illustration of a vault for the savings tracker

Allot a two-page spread on your bujo for this layout. Dedicate the left page to a savings tracker and the right page to a shopping tracker. Using a pencil, draw an outline of a vault that is huge enough to cover 80% of the page. This is where you’ll log your savings in consecutive increments starting from $20 up to $1000.

Add the bills

Use a ruler to draw 50 mini rectangles of equal dimensions inside the vault. These will serve as dollar bills arranged in consecutive even amounts. Start with the first bill labeled as $20, the next should be $40, and so on.

Draw the table for the shopping tracker

Draw an outline of a table extending the whole length of the right page. The columns should be labeled with details in this order:

Date

Item

$ (for cash purchases)

CC (for credit card purchases)

Cost (individual price)

Total (sum of all purchases in a day)

Make the space for the “Item” column wider than the rest to accommodate longer item descriptions.

Trace the outlines in ink

Once the vault, bills, and tracker table have been drawn, you can trace the pencil marks with a ballpoint pen to make them permanent.

Log your savings and expenses

Shade the amount of the bill you have saved on any day using your preferred color pens. For the spending logs, indicate the date of purchase, item description, payment option, and total amount spent.

Supply:

- Notebook

- Pen

- Ruler

- Marker

- Pencil

Variations for Savings Vs. Shopping Tracker Bujo Layout

My version of the savings vs. shopping tracker layout is designed to give you an overview of your available funds and splurges. Meanwhile, there are other designs where journalers come up with visually appealing illustrations intended to make money management more fun.

For instance, there’s a design wherein an empty is filled with coins of specific amounts until they reach the rim. As for the shopping trackers, a few designs incorporate another column dedicated to identifying whether the purchases were made online or through a local store.

When Savings Vs. Shopping Tracker Layout Might Be Most Helpful

A savings vs. shopping tracker layout is most helpful for those who want to be diligent about living on a budget. Some people just aren’t fond of digitalizing everything, especially when it comes to money matters. This is when an analog tracker (aka, tracking money with pen and paper) proves to be very useful.

Handwritten budgets work better for man many people. Apps can detract from the mindfulness-filled expereince of filling out a budget by hand. Manual calculations keep us connected to our money in a way that auto-population and imported receipts done.

On the other hand, using mobile apps for tracking your finances may expose you to data privacy issues 2. This can be a huge concern since you may unknowingly provide information on your credit card purchases using these digital trackers.

When Should You NOT Use Savings vs Shopping Tracker Layout

While the shopping tracker can help monitor your spending habits, it’s not suitable for tracking expenses on basic necessities. This savings vs. shopping tracker layout is more geared towards splurges and mindful saving. Hence, it’s not a good idea to include expenditures on groceries, transportation, etc., which understandably are mainstays in every individual’s budget.

I suggest that you use a separate budget tracker layout that helps monitor your spending on basic necessities, for which you need to set aside money on a regular basis.

Final Thoughts on Using Savings vs. Shopping Tracker Layout in 2022

This savings vs. shopping tracker layout still works great for journalers in 2022, especially with the trend that encourages analog and offline documentation. In this article, you have learned how to use the layout for tracking your savings and purchases, as well as how to personalize your trackers with design variations.

Image Description for Screen Readers

The image shows a bullet journal notebook opened on a spread entitled “Savings Tracker” and “Spending Tracker”. On the upper right side of the notebook are two Stabilo Boss highlighter pens in purple and pink.

The left page of the spread is entitled “Savings Tracker”. Below the title is an illustration of a large vault containing bills of different amounts.

The order of the bills from left to right shows a consecutive even amount starting from $20 to $1000. The amount represents succeeding savings in this order: 20, 40, 60, 80, 100, 120, 140, 160, 180, 200, 220, 240, 260, 280, 300, 320, 340, 360, 380, 400, 420, 440, 460, 480, 500, 520, 540, 560, 580, 600, 620, 640, 660, 680, 700, 720, 760, 780, 800, 820, 840, 860, 880, 900, 920, 940, 960, 980, and 1000.

On the right page of the spread is a table entitled “Spending Tracker”. The columns are labeled from left to right as “Date”, “Item”, “$”, “CC”, “Cost”, and “Total”. Each column is filled with purchase descriptions, the amount of each item, and the total cost spent on specific dates, as well as check marks that indicate if the purchase has been made through cash ($) or credit card (CC).

Sources

- Azmi, N. and Ramakrishnan, S. 2018. Relationship between Financial Knowledge and Spending Habits among Faculty of Management’s Staff[↩]

- Ovida, S. 2021. Stay Safe From App Tracking[↩]